All Categories

Featured

Table of Contents

- – Breaking Down Fixed Vs Variable Annuity A Comp...

- – Exploring Fixed Vs Variable Annuity Pros And C...

- – Breaking Down Your Investment Choices A Close...

- – Breaking Down Your Investment Choices A Close...

- – Exploring the Basics of Retirement Options K...

- – Analyzing Fixed Vs Variable Annuity Pros And...

- – Black Swan Insurance Group

- – Decoding How Investment Plans Work A Compreh...

Set annuities normally offer a fixed rate of interest for a defined term, which can range from a couple of years to a lifetime. This makes certain that you recognize specifically how much revenue to anticipate, simplifying budgeting and financial preparation. For more details on dealt with annuities and their benefits, go to the Insurance Policy Info Institute.

These benefits come at a cost, as variable annuities often tend to have higher costs and expenses contrasted to repaired annuities. Repaired and variable annuities serve various purposes and provide to varying economic concerns.

Breaking Down Fixed Vs Variable Annuity A Comprehensive Guide to Fixed Vs Variable Annuity Pros And Cons What Is the Best Retirement Option? Advantages and Disadvantages of What Is A Variable Annuity Vs A Fixed Annuity Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Explained in Detail Key Differences Between Annuity Fixed Vs Variable Understanding the Key Features of Long-Term Investments Who Should Consider Fixed Annuity Vs Variable Annuity? Tips for Choosing Variable Annuities Vs Fixed Annuities FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Growth Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

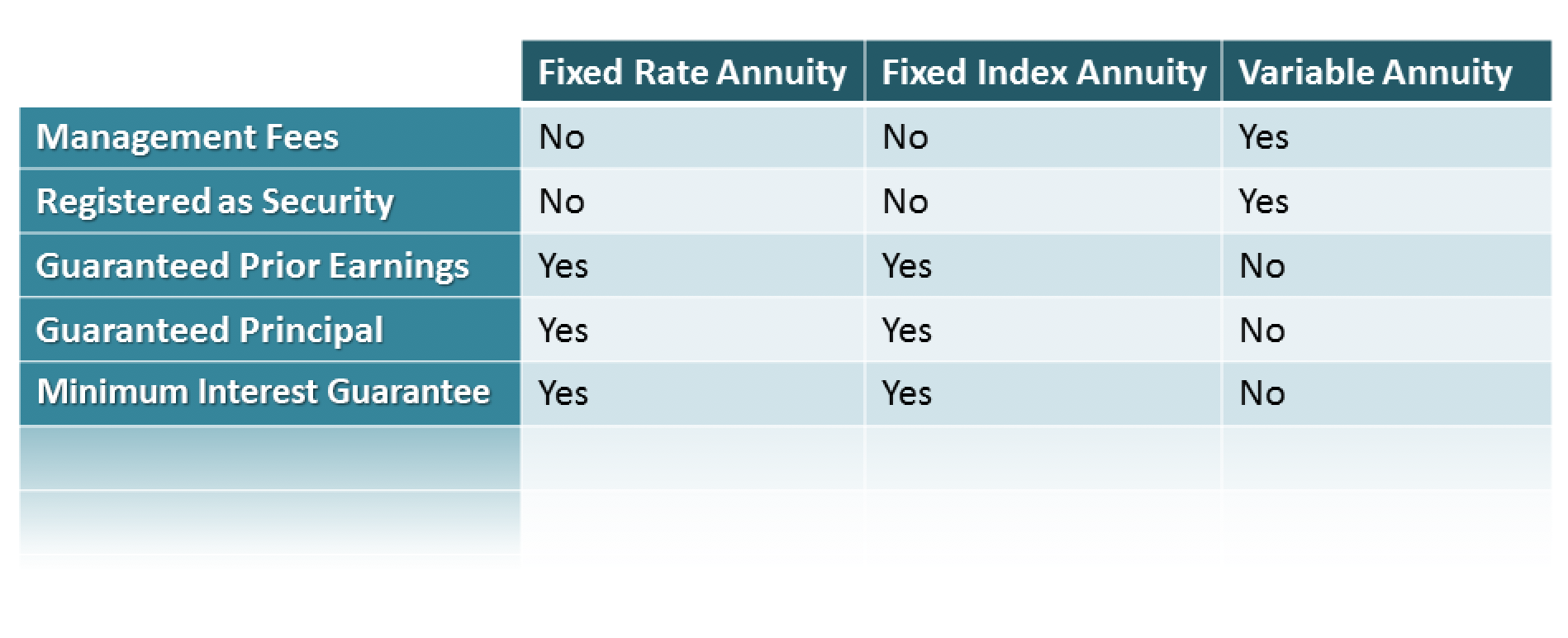

Much less adaptable, with taken care of payments and limited customization. More flexible, permitting you to pick sub-accounts and change financial investments. Typically have reduced costs, making them cost-efficient. Higher charges due to financial investment management and additional functions. For a detailed comparison, explore united state News' Annuity Introduction. Fixed annuities offer several benefits that make them a popular choice for conventional capitalists.

Furthermore, repaired annuities are simple to understand and take care of. The foreseeable nature of fixed annuities likewise makes them a reputable tool for budgeting and covering essential expenses in retired life.

Exploring Fixed Vs Variable Annuity Pros And Cons A Comprehensive Guide to Variable Vs Fixed Annuities Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Interest Annuity Vs Variable Investment Annuity: A Complete Overview Key Differences Between Annuities Fixed Vs Variable Understanding the Risks of Long-Term Investments Who Should Consider Fixed Vs Variable Annuity Pros And Cons? Tips for Choosing the Best Investment Strategy FAQs About What Is Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing What Is A Variable Annuity Vs A Fixed Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

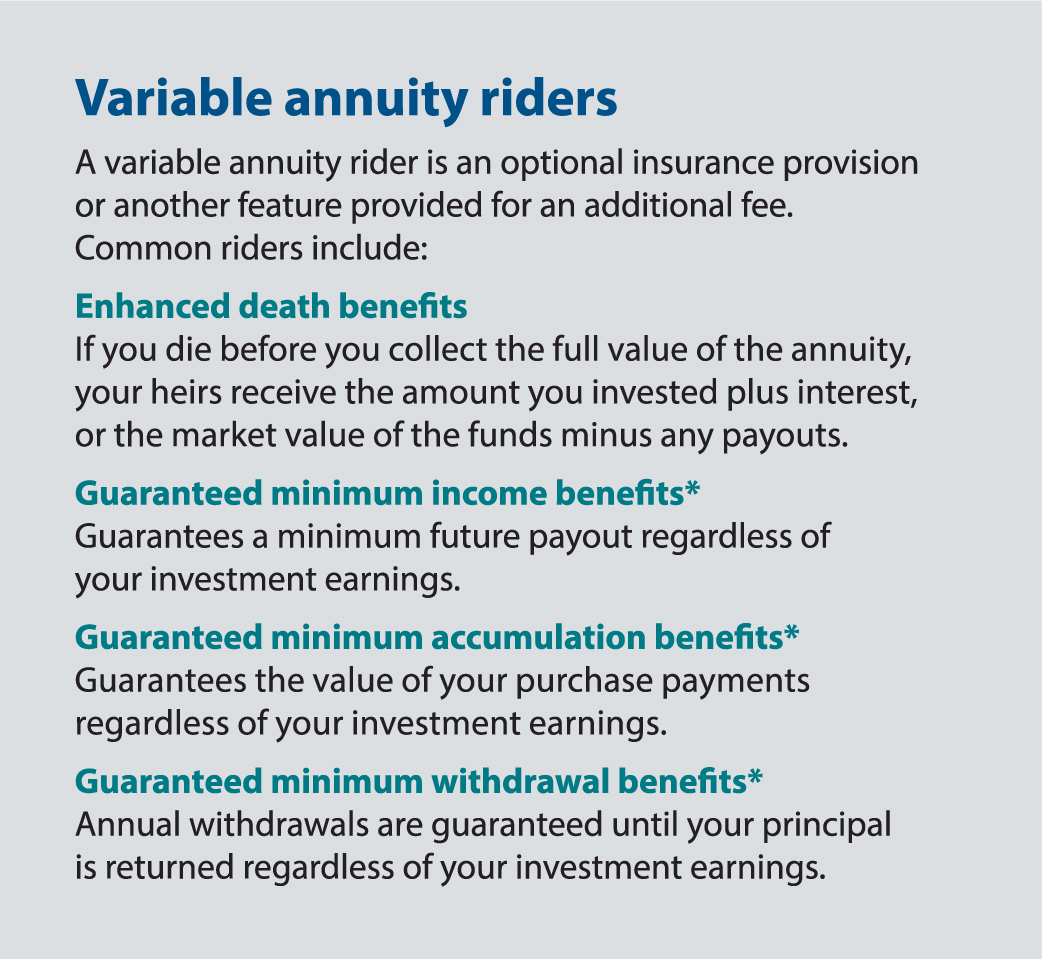

These functions give extra protection, making certain that you or your recipients obtain a predetermined payment no matter of market performance. It's important to note that these advantages often come with extra prices. Variable annuities use a special combination of development and safety and security, making them a versatile option for retired life preparation.

Retirees trying to find a secure earnings resource to cover essential expenditures, such as real estate or healthcare, will certainly benefit most from this type of annuity. Fixed annuities are likewise well-suited for traditional capitalists that wish to avoid market threats and concentrate on protecting their principal. Additionally, those nearing retirement might locate fixed annuities specifically valuable, as they supply ensured payouts throughout a time when financial security is essential.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Advantages and Disadvantages of Variable Annuity Vs Fixed Indexed Annuity Why Choosing the Right Financial Strategy Is a Smart Choice Retirement Income Fixed Vs Variable Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Fixed Interest Annuity Vs Variable Investment Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Variable Annuity Vs Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Variable annuities are better suited for people with a greater risk resistance who are aiming to optimize their financial investment development. More youthful retired people or those with longer time horizons can benefit from the growth potential used by market-linked sub-accounts. This makes variable annuities an attractive choice for those who are still concentrated on accumulating wide range during the onset of retirement.

An annuity is a lasting, tax-deferred investment created for retirement. It will vary in value. It permits you to produce a taken care of or variable stream of income with a process called annuitization. It supplies a variable rate of return based on the efficiency of the underlying financial investments. An annuity isn't intended to replace emergency funds or to fund short-term financial savings goal.

Your options will certainly influence the return you make on your annuity. Subaccounts usually have no guaranteed return, yet you may have a choice to place some cash in a fixed interest price account, with a price that will not change for a set period. The worth of your annuity can change everyday as the subaccounts' values transform.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Pros And Cons Of Fixed Annuity And Variable Annuity Is Worth Considering Indexed Annuity Vs Fixed Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Variable Vs Fixed Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Income Annuity Vs Variable Growth Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Variable Annuity Vs Fixed Indexed Annuity A Closer Look at How to Build a Retirement Plan

However there's no guarantee that the worths of the subaccounts will enhance. If the subaccounts' values go down, you might end up with much less cash in your annuity than you paid right into it. - The insurance company provides a guaranteed minimum return, plus it provides a variable rate based upon the return of a particular index.

Shawn Plummer, CRPC Retirement Planner and Insurance Policy Agent Feature/CharacteristicFixed Index AnnuitiesVariable AnnuitiesEarnings are based on a formula linked to a market index (e.g., the S&P 500). The optimum return is generally capped. No guaranteed principal defense. The account value can decrease based on the efficiency of the underlying investments. Typically taken into consideration a reduced risk as a result of the assured minimum value.

It might provide an ensured fatality advantage alternative, which could be higher than the current account worth. A lot more complex due to a selection of investment options and features.

Exploring the Basics of Retirement Options Key Insights on Variable Vs Fixed Annuity What Is Fixed Income Annuity Vs Variable Growth Annuity? Benefits of Pros And Cons Of Fixed Annuity And Variable Annuity Why Annuities Fixed Vs Variable Matters for Retirement Planning Variable Annuity Vs Fixed Indexed Annuity: How It Works Key Differences Between Pros And Cons Of Fixed Annuity And Variable Annuity Understanding the Risks of Fixed Annuity Vs Equity-linked Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About What Is Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing Indexed Annuity Vs Fixed Annuity Financial Planning Simplified: Understanding Annuity Fixed Vs Variable A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at Annuity Fixed Vs Variable

Suitable for those going to handle even more risk for possibly higher returns. FIAs are developed to secure your principal financial investment, making them an appealing choice for traditional investors. Thanks to a assured minimum value, your initial investment is secured, regardless of market performance. This security is a significant draw for those seeking to avoid the volatility of the marketplace while still having the potential for growth.

This setup attract capitalists who like a modest development potential without significant risk. VAs use the capacity for substantial development without any cap on returns. Your incomes depend totally on the performance of the chosen sub-accounts. This can result in considerable gains, however it likewise suggests approving the possibility of losses, making VAs ideal for financiers with a higher risk tolerance.

They are perfect for risk-averse financiers looking for a risk-free financial investment alternative with modest development capacity. VAs come with a greater risk as their value undergoes market fluctuations. They are suitable for financiers with a greater threat resistance and a longer financial investment horizon who aim for greater returns despite potential volatility.

They might include a spread, engagement price, or other costs. VAs usually lug higher costs, consisting of mortality and expense threat charges and management and sub-account administration charges.

FIAs offer even more foreseeable income, while the income from VAs might differ based upon investment performance. This makes FIAs more suitable for those seeking security, whereas VAs are suited for those willing to accept variable revenue for potentially higher returns. At The Annuity Specialist, we understand the obstacles you encounter when choosing the ideal annuity.

Analyzing Fixed Vs Variable Annuity Pros And Cons A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity Defining Fixed Index Annuity Vs Variable Annuities Pros and Cons of Various Financial Options Why Fixed Income Annuity Vs Variable Annuity Can Impact Your Future Fixed Income Annuity Vs Variable Growth Annuity: How It Works Key Differences Between Annuities Fixed Vs Variable Understanding the Rewards of Variable Vs Fixed Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Indexed Annuity Vs Market-variable Annuity FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing Variable Annuities Vs Fixed Annuities Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at Fixed Annuity Or Variable Annuity

We think in finding the finest solution at the lowest costs, ensuring you accomplish your financial objectives without unnecessary costs. Whether you're looking for the security of major security or the possibility for higher earnings, we use tailored suggestions to assist you make the finest decision.

Based on the initial consultation, we will create a tailored annuity plan that suits your specific needs. We will certainly discuss the attributes of FIAs and VAs, their advantages, and just how they fit into your general retired life approach.

However, dealing with The Annuity Expert guarantees you have a safe and secure, well-informed strategy customized to your needs, leading to a monetarily stable and hassle-free retired life. Experience the self-confidence and safety that features understanding your monetary future is in professional hands. Call us today totally free guidance or a quote.

This service is. Fixed-indexed annuities guarantee a minimum return with the possibility for even more based upon a market index. Variable annuities supply investment choices with greater threat and benefit possibility. Fixed-indexed annuities provide disadvantage defense with minimal upside potential. Variable annuities offer more significant benefit capacity yet have higher fees and better danger.

His mission is to simplify retirement planning and insurance policy, making certain that clients comprehend their options and protect the very best insurance coverage at unsurpassable prices. Shawn is the creator of The Annuity Professional, an independent on the internet insurance firm servicing customers across the USA. Via this system, he and his group purpose to get rid of the uncertainty in retired life preparation by aiding people find the best insurance policy coverage at the most affordable prices.

Decoding How Investment Plans Work A Comprehensive Guide to Deferred Annuity Vs Variable Annuity Defining Fixed Income Annuity Vs Variable Growth Annuity Benefits of Choosing the Right Financial Plan Why Indexed Annuity Vs Fixed Annuity Can Impact Your Future Fixed Vs Variable Annuity Pros And Cons: How It Works Key Differences Between Variable Annuity Vs Fixed Indexed Annuity Understanding the Risks of Annuities Fixed Vs Variable Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing Variable Annuity Vs Fixed Indexed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Income Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

As you explore your retired life alternatives, you'll likely encounter greater than a couple of financial investment strategies. Contrasting various kinds of annuities such as variable or set index belongs to the retired life planning procedure. Whether you're close to old age or years far from it, making clever decisions at the onset is vital to gaining one of the most reward when that time comes.

Any quicker, and you'll be fined a 10% early withdrawal fee on top of the income tax owed. A fixed annuity is essentially a contract in between you and an insurance provider or annuity company. You pay the insurer, through a representative, a premium that grows tax deferred gradually by a rate of interest identified by the agreement.

The terms of the contract are all set out at the start, and you can establish points like a fatality benefit, earnings bikers, and other numerous options. On the other hand, a variable annuity payout will be established by the performance of the investment alternatives selected in the contract.

Table of Contents

- – Breaking Down Fixed Vs Variable Annuity A Comp...

- – Exploring Fixed Vs Variable Annuity Pros And C...

- – Breaking Down Your Investment Choices A Close...

- – Breaking Down Your Investment Choices A Close...

- – Exploring the Basics of Retirement Options K...

- – Analyzing Fixed Vs Variable Annuity Pros And...

- – Black Swan Insurance Group

- – Decoding How Investment Plans Work A Compreh...

Latest Posts

New York Life Annuities Death Benefit Form

Riversource Privileged Assets Annuity

Athene Annuity And Life Insurance Co

More

Latest Posts

New York Life Annuities Death Benefit Form

Riversource Privileged Assets Annuity

Athene Annuity And Life Insurance Co